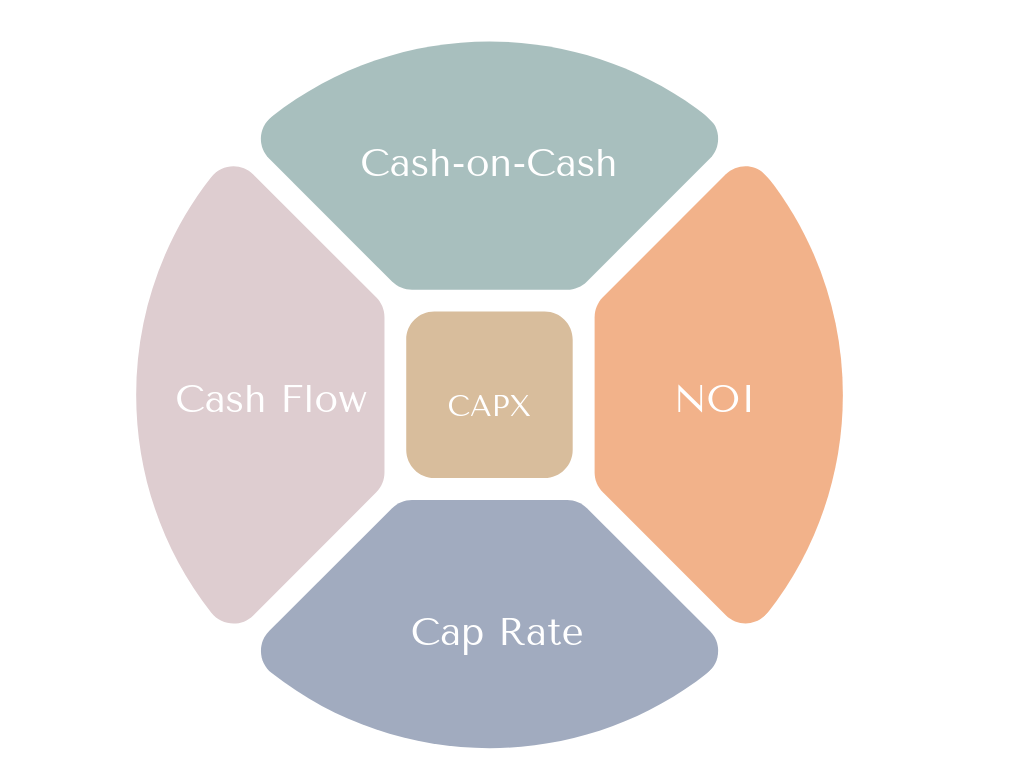

Once you know these terms you’ll be able to understand the lingo most investors use when they talk about real estate.

Cash Flow

Cash Flow is the amount of money you have to spend at the end of the month after paying all loan payments and all operating expenses.

Rent – all expenses including {loan payments} = Cash Flow

This is a very important number because if your cash flow is a positive number it means you are making money and if it is negative you are losing money.

Net Operating Income (NOI)

Net Operating Income or NOI is perhaps one of the most important terms in real estate. This number allows us to compare all properties based on how much income they make before loan payments are made. Think of it like a batting average or Grade Point Average.

Net Operating Income is computed this way:

Rent – Property Expenses = Net Operating Income (NOI)

Property expenses include property taxes, insurance, management fees, CAPX, HOA, water, sewer, lawn care, electric, gas, maintenance, vacancy loss to name a few.

Cap Rate

Cap Rate or Capitalization Rate is another term that helps us measure how successful a real estate investments will be. It is computed by dividing the Net Operating Income (NOI) by the purchase price of the property to find out the yearly rate of return of a property.

NOI / (Property Sales Price) = Cap Rate %

This number is expressed as a percentage. The lower the Cap Rate usually reflects properties that are low risk and those of higher Cap Rate are more riskier.

But here’s another way to look at this. If you can increase the NOI you can increase the value of the property. Let’s say you made some repairs and raised the rents. To keep the same Cap Rate you would have to raise the property price to maintain the same Cap Rate.

Cash-On-Cash Return

This is another great term which is bantered about in real estate circles. Cash-on-Cash is calculated by dividing the yearly pre-tax cash flow by the total amount of cash invested in the property expressed as a percentage.

Cash Flow / (Total Invested ) = Pre Tax Cash-on-Cash%

Total Cash Invested is really the amount of money you placed in the deal . This includes any money spent for downpayment, loan points, closing costs and any additional money it took to close a deal. Cash Flow is the pre-tax cash flow we described earlier.

CapX

CapX or Capital Expenditures is the money you want to spend to make major purchases for property improvements that extend the life of the property. Some of these include roof replacements, new doors updating windows, new furnace and siding etc..

This is a brief summary of the 5 real estate terms you need to know. Here in review are

- CapX = major purchases to extend life of property

- Cash-On-Cash = Yearly Cash Flow/(cash invested)

- Cash Flow=Rent – Total Expenses – Mortgage

- Cap Rate =NOI / (Property Sales Price) %

- NOI = Rent – Total Expenses

If you have a property you want to evaluate try our free real estate investor calculators