If you are considering joining the world of real estate investing, understanding the five main reasons you should buy a rental property are important. This knowledge will help you decide to take the plunge and better understand the business you are entering.

The five reasons for buying rental properties are appreciation, cash flow, depreciation, equity, and cash flow. Here’s more on each of these.

Appreciation

Appreciation is the increase in the value of your rental property over time. It’s like trying to predict the future. Still, that’s your task when trying to determine how much rental property will appreciate over time.

Historical averages can give us some idea. But over the short term that can vary wildly from the averages. Ask anyone who bought just before the last recession. Home prices dropped dramatically and did not recover fully for several years. Local differences can also be dramatic. Just as Texas houses might rise or fall at different rates than Illinois, so could those in Austin and Houston.

Even though it is impossible to know what housing prices are going to do over a certain period of time, there is a good rule of thumb to follow. Over a long enough period, housing appreciation will approximate inflation. If housing prices rose faster than inflation over a long time, eventually people would not be able to afford to buy.

Appreciation is especially beneficial if you purchased the property with a bank loan, as is typical. Suppose you bought a $200,000 property with a $20,000 down payment. All appreciation goes to you, despite having paid only 10 percent down. This kind of leverage is key to real estate investing.

Cash Flow

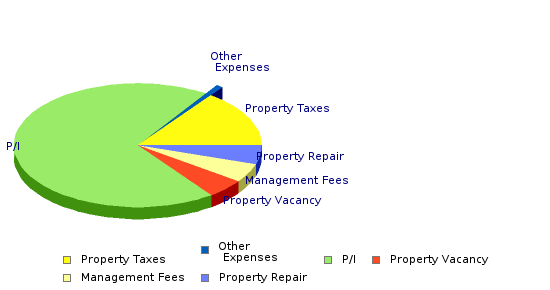

The cash flow generated from rental properties might well be more important to you than appreciation. Generating positive cash flow is a simple idea. If rent is greater than all the expenses of the rental property then the difference is cashflow. While some may be content for negative cash flow, planning to profit when selling, positive cash flow is quite appealing for a number of reasons.

If the real estate market drops, a profit can still be turned due to cash flow. Also, it is not unusual for cash flow to increase over time. Rents will rise and expenses could fall. Positive cash flow means the mortgage will be paid for, increasing the equity of a home. In addition, cash flow can give an investor a chance to use profits to purchase more properties.

Depreciation

Even with positive cash flow with a rental home that appreciates in value, you’re allowed to make certain tax deductions. Any expenses incurred, such as property taxes, insurance, and others, are allowed to be deducted in the year they occur.

Residential properties are depreciated over 27.5 years

However, depreciation works differently. Depreciation is a process where you’re allowed to deduct the costs of buying and improving the rental property. Instead of yearly, this deduction is spread out over what is referred to as the “useful life” of the property.

The Internal Revenue Service has specific rules to be followed for depreciation. The IRS currently has four criteria that must be met.

• The investor owns the property, even if there is a mortgage.

• The property either produces rental income or is used in business.

• The property is expected to last more than a year.

• The property’s useful life can be determined.

Investors may continue to depreciate the property until all its cost have been depreciated, or if the home is abandoned, destroyed, or otherwise been taken out of service.

Residential properties made available to rent after 1986 is depreciated over 27.5 years. This is the amount of time the IRS has determined to be the useful life of a rental property.

Any investor should seek the counsel of a reliable tax accountant when determining the amount of depreciation.

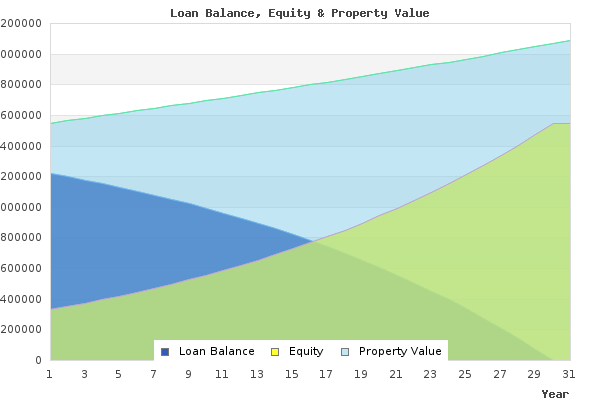

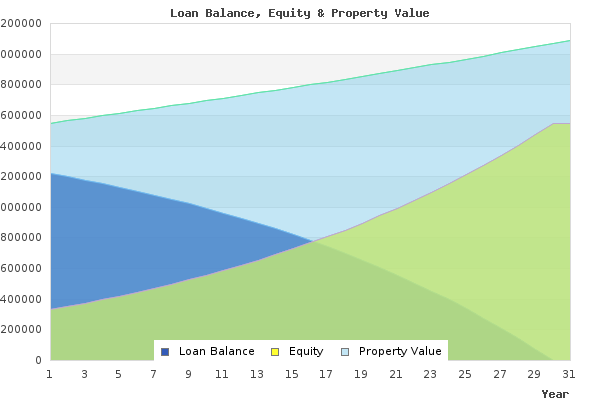

Equity

Equity is merely the difference between the current market value of a home and the balance on any mortgages. There are several different ways to determine the market value of a home.

• Using a home appraiser.

• Tax assessments.

• Using an online comparison tool.

• Running a market analysis of similar homes in your area.

• Compare homes recently sold to determine a price per square foot. Multiply that number by the square footage of your home.

Once an investor knows the value of his home, that equity can be put to use. Typically this is done via a loan in two scenarios.

In the first, a homeowner uses the equity to get a refinance loan. This is often done when a larger lump sum of cash is required, such as when major repairs are needed. If an investor has a significant number of properties, some lenders might be reluctant to issue such a loan. Shop around and ask questions to determine if this is the case.

If improvements are made to the rental income, it is appropriate to consider raising rents to cover the costs of the loan.

A second way to use your equity is through a line of credit. This type of loan operates much the same way as a secured credit card. The loan is secured by the equity in the home. These type of loans are better for an investor who has an ongoing need instead of a one-time event.

Some banks may not offer home equity loans on rental properties. Even if they do, they might not loan as great amount as they would for a primary residence. Investors should keep that in mind as they shop for loans.

Profit from Sale

Hopefully, you have accrued profits from some or all the above. At some point, he may want to take advantage of the last way to make a profit. That happens when you sell your rental property. One major problem to deal with is capital gains taxes, which can be significant.

There are three ways to legitimately mitigate capital gains taxes on the sale of a rental property. One is by a process called tax-loss harvesting. All this means is that your capital gains can be offset by other capital losses.

A second way is by deferring the capital gains taxes by using the sales proceeds to purchase a “like-kind” property. The term “like-kind” has a broad interpretation, a benefit to the investor. To do this type of transaction, the investor must identify a replacement property within 45 days and close on the property within 180 days.

Lastly, an investor can avoid some of the capital gains taxes by converting a rental property into a primary residence. He would need to know in advance as this requires living in the home for two years to use this tactic.